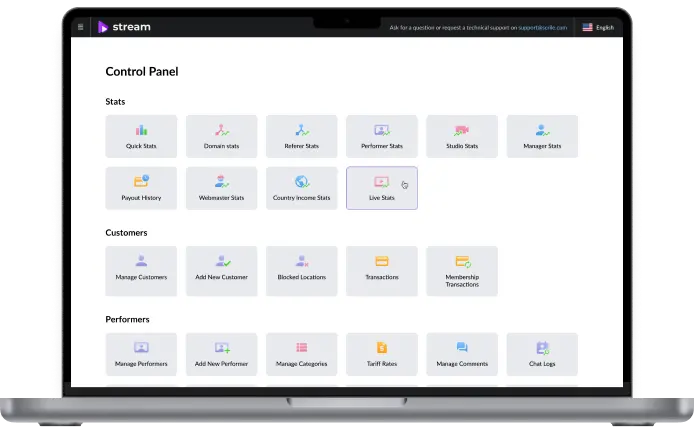

Your personal control panel

Control every aspect of your webcam site: stats, customers, performers, webmasters, system configuration and studios

3 measure reasons to start a webcam business

Cost-effective, with minimal initial investment and the potential for significant revenue.

Global accessibility, reaching potential customers worldwide, wide range of niches.

Subscriptions, pay-per-view sessions, exclusive shows, and video content sales.

Elevate your subscription-based site game

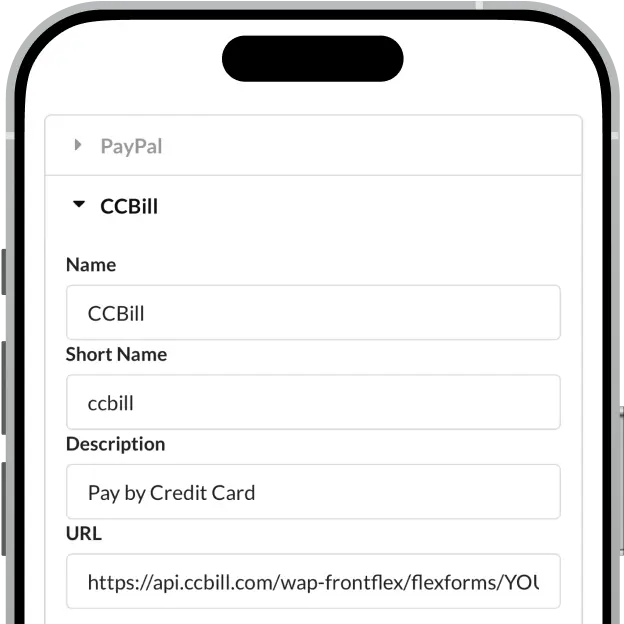

Seamless integration with online payment systems ensures direct transactions to your merchant account.

We offer a variety of templates, which are beautifully designed and easily supported.

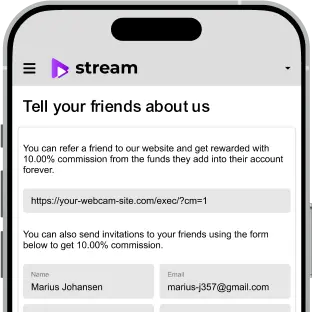

Users, models and webmasters can attract new customers to your site to earn for itself.

Launch successfully with essential built-in features of Scrile Stream for your webcam site

Building and delivering innovative digital solutions with cloud-native technologies and Kubernetes

We offer hosting services in the largest data centres in USA and Europe, most suited to our software.

We can develop a unique design layout according to your needs and install it on your site.

Our highly skilled programming team is always ready to implement your unique ideas.

Our team is always ready to provide technical support, making sure your site runs smoothly.

We have put together some commonly asked questions

Do you provide hosting?

Can I modify the site look?

Do you provide technical support after the purchase?

Do I need to have coding skills?

Can I host software on my own server?

Is it in compliance with the law?